An Employer’s Guide To Properly Conducting I-9 Audits

PSI Team | UncategorizedAn Employer’s Guide To Properly Conducting I-9 Audits

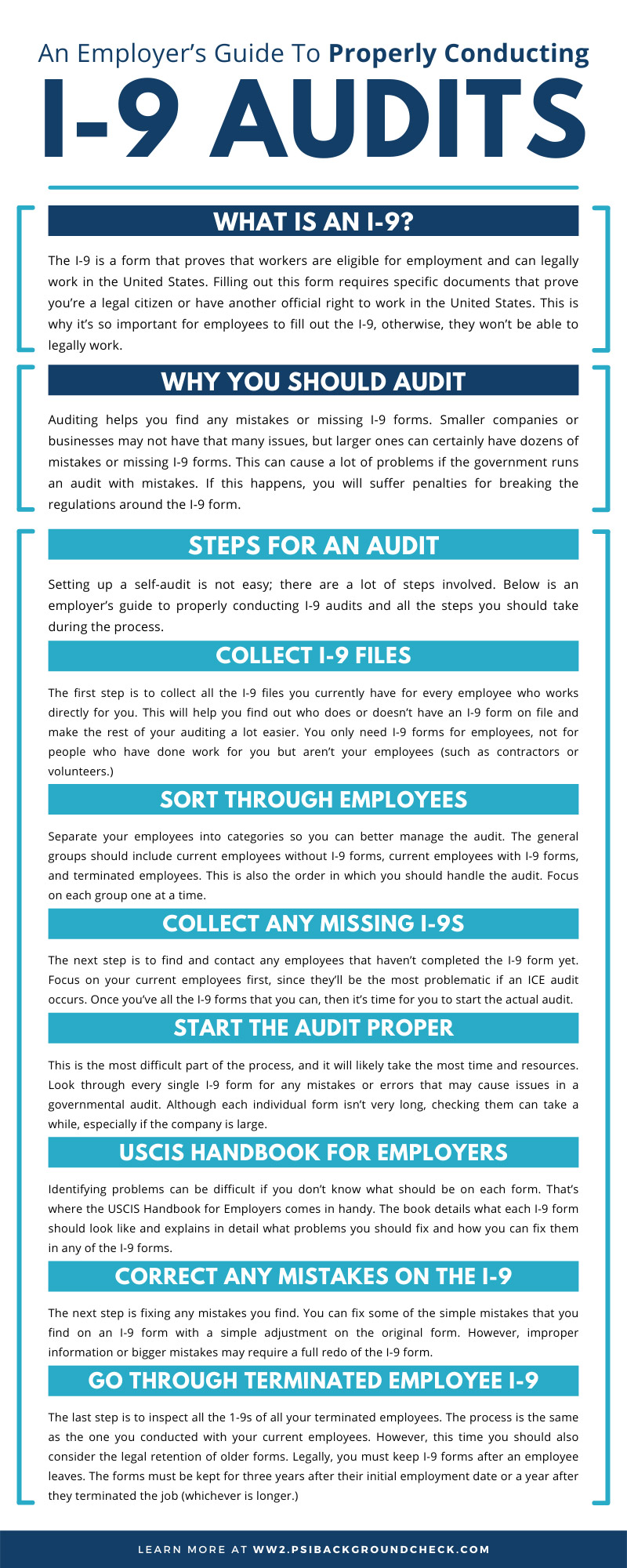

Every employee in a company must fill out an I-9 form within three days of their hiring. This is extremely important as the United States government requires this of every company. It’s so important that many companies perform self-audits of their I-9 forms before the government does to ensure they’re following the correct procedures and rules. Here’s an employer’s guide to properly conducting I-9 audits so you can avoid problems.

What Is an I-9?

If you’ve never understood the purpose of an I-9 or why the government requires it, here’s its main purpose. The I-9 is a form that proves that workers are eligible for employment and can legally work in the United States. Filling out this form requires specific documents that prove you’re a legal citizen or have another official right to work in the United States. This is why it’s so important for employees to fill out the I-9, otherwise, they won’t be able to legally work.

Why You Should Audit

Auditing helps you find any mistakes or missing I-9 forms. Smaller companies or businesses may not have that many issues, but larger ones can certainly have dozens of mistakes or missing I-9 forms. This can cause a lot of problems if the government runs an audit with mistakes. If this happens, you will suffer penalties for breaking the regulations around the I-9 form.

Penalties

If you ever face a government audit and don’t have all your I-9 forms in order, you can face huge fines. In such cases, the U.S. Department of Homeland Security (DHS) and U.S. Immigration and Customs Enforcement (ICE) will come in and look through every I-9 form you have. If you’re missing any or they have mistakes, they’ll fine you for the breach in regulation. The cost of every fine can quickly add up to tens of thousands—if not millions—if you have enough violations. This is why running a self-audit is so important and can save you a lot of money.

Steps for an Audit

Setting up a self-audit is not easy; there are a lot of steps involved. Below is an employer’s guide to properly conducting I-9 audits and all the steps you should take during the process.

Collect I-9 Files

The first step is to collect all the I-9 files you currently have for every employee who works directly for you. This will help you find out who does or doesn’t have an I-9 form on file and make the rest of your auditing a lot easier. You only need I-9 forms for employees, not for people who have done work for you but aren’t your employees (such as contractors or volunteers.)

Sort Through Employees

Separate your employees into categories so you can better manage the audit. The general groups should include current employees without I-9 forms, current employees with I-9 forms, and terminated employees. This is also the order in which you should handle the audit. Focus on each group one at a time.

Collect Any Missing I-9s

The next step is to find and contact any employees that haven’t completed the I-9 form yet. Focus on your current employees first, since they’ll be the most problematic if an ICE audit occurs. Once you’ve all the I-9 forms that you can, then it’s time for you to start the actual audit.

Start the Audit Proper

This is the most difficult part of the process, and it will likely take the most time and resources. Look through every single I-9 form for any mistakes or errors that may cause issues in a governmental audit. Although each individual form isn’t very long, checking them can take a while, especially if the company is large.

USCIS Handbook for Employers

Identifying problems can be difficult if you don’t know what should be on each form. That’s where the USCIS Handbook for Employers comes in handy. The book details what each I-9 form should look like and explains in detail what problems you should fix and how you can fix them in any of the I-9 forms. This handbook will be your best resource when you are going through all the I-9 forms looking for mistakes.

Correct Any Mistakes on the I-9

The next step is fixing any mistakes you find. You can fix some of the simple mistakes that you find on an I-9 form with a simple adjustment on the original form. However, improper information or bigger mistakes may require a full redo of the I-9 form. If you want a more detailed explanation about the different mistakes and how you can fix them, then use the USCIS Handbook for Employers as your guide.

Go Through Terminated Employee I-9

The last step is to inspect all the 1-9s of all your terminated employees. The process is the same as the one you conducted with your current employees. However, this time you should also consider the legal retention of older forms. Legally, you must keep I-9 forms after an employee leaves. The forms must be kept for three years after their initial employment date or a year after they terminated the job (whichever is longer.) After that period has passed, you can then get rid of it. This can save you a lot of storage space over the years and means that you can audit fewer files than if you kept them. So be sure you go through and properly destroy any I-9 forms before you perform this part of the audit.

This is the whole process of running your own audit on the I-9 form. Although it sounds like a lot of work, the money it can save you from fines is worth it. If you want to make the entire audit easier for you and your company, then hire I-9 verification services and outsource other parts of the process.